Discover 100+ years of

Fitch Group history

Our story spans a century of independent thinking, shaped by commitment to transparency, inclusivity,

and clients. Today, our legacy continues to drive how we inform markets and build trust worldwide.

Our history

A legacy of insight, innovation, and global trust since 1913.

Fitch Publishing Company Inc. was launched in New York by three investors, John Knowles Fitch (1880–1943), Henry P. Clancy, and Fabian Levy.

Fitch Publishing Company Inc. was launched in New York by three investors, John Knowles Fitch (1880–1943), Henry P. Clancy, and Fabian Levy. Their most successful product was the Fitch Bond Book, a compendium of user-friendly bond data which was delivered directly to investors. It was also known as the “Fitch Investors Service”.

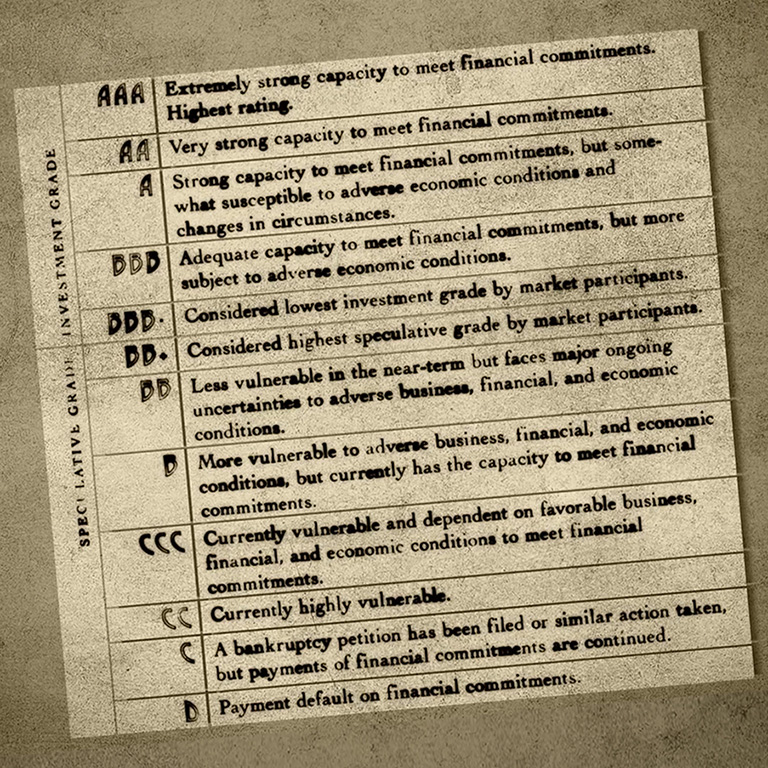

Fitch standardises creditworthiness with the launch of the letter-grade rating system.

Fitch, now with offices in New York, Chicago and Boston, developed and introduced what has since become the most common letter-grade scoring system (AAA, AA, A, BBB, BB, etc.) for the credit-worthiness of all kinds of corporations.

Duff & Phelps was founded in Chicago by William Duff and George Phelps, with a focus on providing investment research, particularly for public utilities.

The company continued expanding over the years; it achieved Nationally Recognized Statistical Rating Organisation(NRSRO) status in 1982, and eventually spun off the Duff & Phelps Credit Rating Co. in 1994.

Thomson BankWatch was founded by the Thomson Corporation in Canada, with a focus on rating banks and other financial institutions.

Thomson BankWatch achieved NRSRO status in 1992, and grew to become the world’s largest bank rating business.

Fitch was one of the first credit rating agencies to be awarded Nationally Recognized Statistical Rating Organization (NRSRO) status by the US Securities and Exchanges Commission (SEC).

Achieving NRSRO status means that a Credit Rating Agency is approved by the SEC to supply financial information that can be used for regulatory purposes.

International Bank Credit Analysis Ltd, more commonly known as IBCA, was founded in London, to provide research, and ultimately credit ratings, to banks.

IBCA gained limited NRSRO status in 1991 for banks and financial institutions.

Fitch merged with IBCA Ltd, significantly increasing Fitch's worldwide presence and coverage in banking, financial institutions, and sovereigns.

Through the merger with IBCA, Fitch became owned by the French holding company, Fimalac S.A., which had acquired IBCA in 1992. The merger of Fitch and IBCA represented the first step in its plan to respond to investors' need for an alternative global, full-service rating agency, capable of successfully competing with Moody's and S&P across all products and market segments.

The next step in building the entity into a global competitor was the merger, in April, between Fitch IBCA and Duff & Phelps Credit Rating Co., from which the modern-day Fitch was created.

This acquisition strengthened Fitch’s coverage in the corporate, insurance, and structured finance sectors, as well as added a significant number of international officesand affiliates. The acquisition later that same year of Thomson BankWatch added research and analysis on over 1000 financial institutions in more than 95 countries’ to the Fitch portfolio.

Hearst Communications, Inc. made its first investment in Fitch.

In 2006, Hearst Corporation made a strategic investment in Fitch Group, enhancing Fitch’s global reach and reinforcing its long-term growth. The move marked a key milestone in Fitch’s evolution, aligning it with one of the world’s most respected media and information companies.

Fitch diversified its ratings business with the launch of Fitch Solutions.

In 2008, Fitch expanded beyond ratings with the launch of Fitch Solutions – providing credit market data, analytical tools, and risk services to support smarter decision-making across global markets.

Fitch expanded its existing training business with the acquisition of 7city Learning, an e-learning specialist company.

The newly created division, Fitch Learning, grew to become a leading global financial education company, offering a complete range of qualification and skills learning programs, blending e-learning and classroom delivery, and training over 25,000 financial professionals per year.

Fitch acquired BMI Research. BMI’s world-className research, data, and analytical capabilities which, when combined with Fitch’s own expertise, significantly expanded the financial information services offering.

Fitch Solutions launched the flagship platform, Fitch Connect.

Fitch Connect was designed to deliver Fitch Ratings credit research, Fitch Ratings credit ratings, macroeconomic and financial fundamental data, and country risk research, as well as indices, industry research, Financial Implied Ratings, and a curated news service.

Fitch Ventures progressed the growth journey as a group. In August 2016, a joint effort between Fitch Group and Hearst was announced, originally named the Financial Venture fund.

Later, the fund moved fully into Fitch Group under the banner of Fitch Ventures, and focused in on the financial services, data and Fintech spaces. Fitch Ventures makes equity investments in innovative and emerging technology companies in the rapidly evolving financial services industry, to help accelerate their commercial growth.

Fitch Group becomes a wholly owned Hearst business. Hearst purchased a final 20% interest in Fitch Group.

Fitch Group became a wholly owned subsidiary of Hearst, which acquired the remaining 20% stake. CEO Paul Taylor highlighted their shared focus on innovation and smarter decision-making. That same year, Fitch acquired Fulcrum Financial Data—Covenant Review, LevFin Insights, and Capital Structure—further strengthening Fitch Solutions’ offerings for capital markets investors.

For 20 years, Fitch Group has been growing internationally, hand in hand with the growth of the financial markets around the world.

The latest chapter in this story is in China, where in May, Fitch Ratings announced that Fitch Bohua had received approval from the People's Bank of China (PBOC) and the National Association of Financial Market Institutional Investors (NAFMII) to rate financial institutions (including banks, non-bank financial institutions and insurers) and their securities, and structured finance bonds in China's interbank market.

In January 2021 Fitch Group announced it will acquire CreditSights, Inc., a leading provider of independent credit research to the global financial community.

Following the closing, CreditSights will become part of Fitch Group's Fitch Solutions division, as it further expands its research coverage of investment grade, leveraged and distressed debt markets.

GeoQuant is imbedded as key component of BMI product offerings.

In 2022, Fitch Group completed its acquisition of GeoQuant, an AI-driven data and technology company that measures and predicts geopolitical and country risks at high frequency. GeoQuant becomes part of BMI, A Fitch Solutions company.

Fitch Group strengthens its position in structured finance and private syndicated loans by acquiring dv01 and Bixby.

A technological innovator, dv01 enhances Fitch’s structured finance offering with loan-level data and fully integrated analytics.

In December, Bixby, a leading provider of credit information on private syndicated loan issuers, was acquired by Fitch. Fitch Ventures led Bixby’s Series A round earlier in the year.

Fitch Learning Agrees to Acquire Moody’s Analytics Learning Solutions and the Canadian Securities Institute from Moody’s.

This acquisition expands Fitch offerings in career development and professional certifications across commercial banking, consumer banking, and investment management.

Throughout our history we’ve constantly looked for ways to pivot and grow as a group, and that spirit continues to this day.

Whether by broadening our product suite or by moving into new regions, our commitment to delivering international perspective through local insight has never been stronger.

As a result of Fitch's growth and acquisitions, we now have over 5,000 employees, including over 1,600 analysts, in over 40 offices and affiliates worldwide.